The Art of Investing: Why Art is More Than Just a Passion Purchase

A Personal Journey: From Admiration to Investment

I still remember the first time I stood before a masterpiece—completely mesmerized, as if the artist had poured time, history, and emotion onto the canvas. It wasn’t just paint and strokes; it was a story, a moment captured forever. That feeling never left me. Over the years, I realized that art isn’t just something to be admired—it’s something to be valued, nurtured, and yes, invested in.

Art has always been more than just a visual experience. It is a narrative, a time capsule of civilizations, a reflection of cultural identity. When we think of the greatest empires, we don’t just recall their military conquests—we remember their artistic legacies. The Renaissance in Europe, Mughal miniatures, the cave paintings of Ajanta—these are the markers of history that continue to shape global culture today.

Yet, beyond its cultural importance, art has also proven to be one of the most enduring and valuable investments. It is not just something to admire—it is an asset that grows in worth, carrying emotional, historical, and financial significance. Just like land, stocks, or gold, art has the potential to appreciate over time—often in ways that surpass traditional investments. The best part? Unlike stocks that exist in numbers or land that remains unseen, art is a living, breathing presence in your life. It inspires, engages, and appreciates, all at once.

The Missed Opportunity: What If You Had Invested in a Husain or a Raza 20 Years Ago?

Not long ago, I met two collectors who had their own stories about the opportunities that once existed in the Indian art market.

One was a retired doctor from the USA. As we spoke, he reminisced about an MF Husain exhibition he attended in the 90s. He recalled how Husain’s paintings were struggling to find buyers, except for two that he purchased himself. Back then, Husain was even willing to sell the entire gallery for ₹30 lakh. With a chuckle, he said, “How I wish I had bought them all.” The look of satisfaction on his face made me realize the power of foresight in art investing.

Another collector shared a different but equally compelling story. Years ago, MF Husain had sent three large water color paintings to his father for ₹45,000. But at the time, that seemed like an excessive amount, so his father decided to keep only one. Years later, as the value of Husain’s work soared, his father became the laughing stock among his collector friends for passing on such a golden opportunity.

These stories are not unique. Time and again, history has shown that those who recognize the potential of art before the market catches up reap the greatest rewards. The only question is—who will be telling these stories 20 years from now?

Imagine owning a masterpiece by M.F. Husain, S.H. Raza, or F.N. Souza at a time when their works were available for a few lakhs. Today, those same paintings are commanding crores at global auctions.

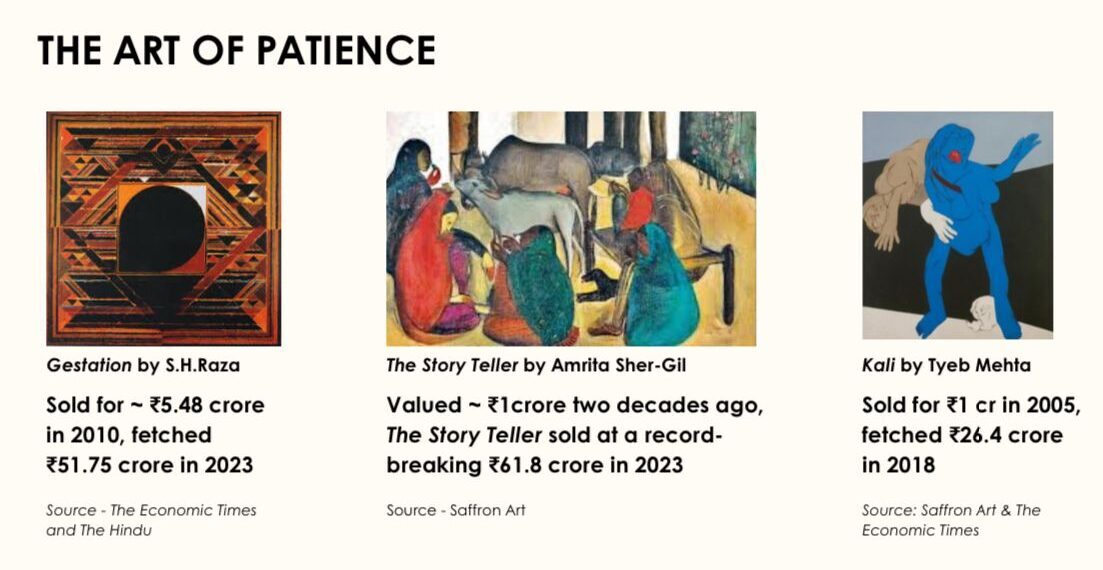

Consider Tyeb Mehta’s Kali, purchased for ₹1 crore in 2005, later selling for ₹26.4 crore in 2018. Or Amrita Sher-Gil’s The Story Teller, which was acquired for ₹5.48 crore in 2010 and soared to ₹61.8 crore in 2023. The numbers tell a compelling story—art isn’t just about aesthetics, it’s about creating generational wealth.

For those who once hesitated, it’s easy to look back and wonder—what if?

I had my own what if moment. Back in college, I attended an exhibition where a small Amrita Sher-Gil painting was priced between ₹40-60 lakh. At the time, the figure seemed astronomical to me. I remember thinking, who buys such an expensive painting? Today, when I look back, it gives me goosebumps. Sher-Gil’s work has since reached heights that now seem almost out of reach. I witnessed her market value rise firsthand, and that experience continues to remind me—art is always ahead of its time, and those who recognize its potential early reap the greatest rewards. But the real question is, will you recognize the opportunity today before history repeats itself?

The Unseen Land vs. The Living Presence of Art

Years ago, I invested in a piece of land in my hometown. It was purely a financial decision—good location, increasing property values. But here’s the catch: I never saw it before purchasing, and to this day, I have no emotional connection to it. It exists only in legal documents, something I own but never truly experience.

Now, contrast that with art. Art is something you live with, interact with, and draw inspiration from every single day. A well-placed painting can transform a space, a sculpture can evoke thought, and a collection can become a source of pride and conversation. Unlike land or stocks, art is both an asset and an experience—a piece of history that you can touch, see, and immerse yourself in.

Why I Chose “Art as Investment” for My Talk at NCPA

I have always believed that art should be an emotional purchase—one that resonates with your life, experiences, and identity. A great piece of art is more than just décor; it is a reflection of the self.

When you buy art, you should see a part of yourself in it, because art has a profound psychological effect on the human mind. Yet, many people fail to understand its true value—not just aesthetically, but financially.

I’ve seen this firsthand. A friend of mine spent crores installing onyx marble flooring throughout his house. He was ecstatic about it, but it left me frustrated. Why? Because while flooring remains unnoticed below eye level, art is what truly transforms a space. Yet, after investing lavishly in materials, people often run out of budget for their walls—settling for generic, uninspired décor. I understand that design choices are personal, but I’ve noticed time and again that when guests visit a home, they rarely comment on the flooring or furniture. Instead, it is the art that becomes the talking point. Art sparks conversation, adds depth to a space, and, most importantly, appreciates in value—both emotionally and financially.

I also know several seasoned collectors who describe the thrill of acquiring a new piece as nothing short of euphoric. They say that buying art gives them a high, an unmatched pleasure that only grows over time. This is something you can only understand once you start collecting.

Surrounded by people from finance backgrounds—those who speak in numbers and ROI—I wanted to bridge the gap between art and investment in a language they understand. That’s why I chose this topic for my talk at NCPA at The Art of India. I brought data-driven insights to an audience that had never considered art as a serious asset class. Through compelling statistics and market trends, I wanted to show them that art is not just about passion—it is a strategic, appreciating investment that belongs in every portfolio.

The Art of India Event: A Shift in Perception

At my talk at the Art of India 2025 event, I had the privilege of speaking to seasoned investors. I have also spoken to bankers and corporate leaders—people who understand finance but had never considered art in the same league as traditional assets.

While interacting with the audience, what struck me was the realization that art investment is still an untapped conversation in mainstream financial circles. While stocks and real estate dominate discussions, art remains an overlooked asset—despite its proven history of appreciation, resilience against economic downturns, and growing global demand.

As I presented the data—how India’s art market is projected to hit ₹19 billion by 2028—I saw the shift happen. The hesitation turned into curiosity, and curiosity turned into conviction. The takeaway was clear—art is no longer just for collectors; it is for smart investors who understand its potential.

India vs. Europe: A Market Ready to Take Off

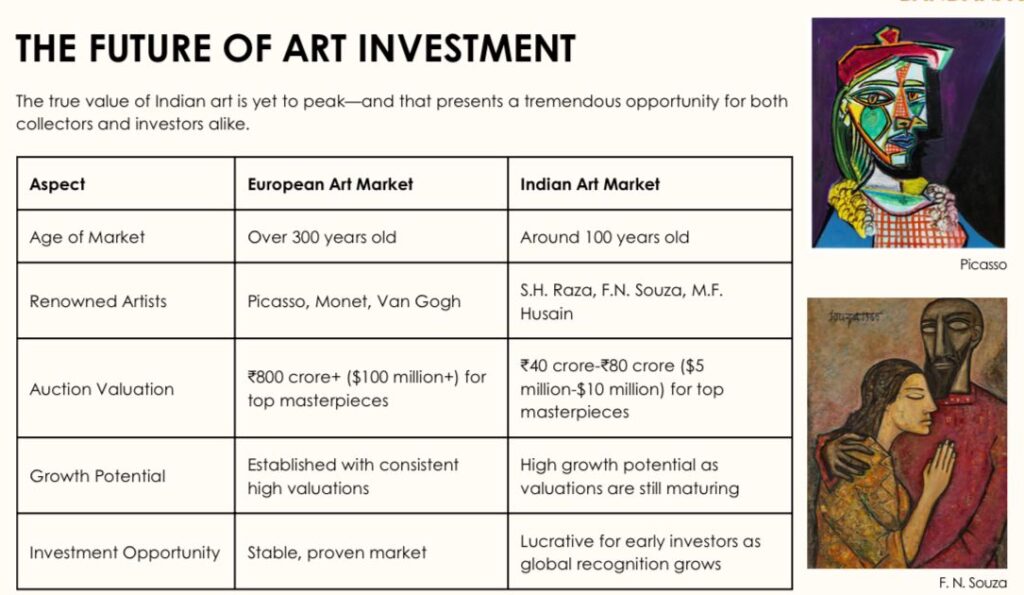

For centuries, Europe has dominated the global art market, with its institutions, museums, and collectors cementing a stable and high-value investment ecosystem. Meanwhile, India, despite its rich artistic heritage, remains significantly undervalued in comparison.

Think about it—top Western masterpieces sell for ₹800 crore+ ($100M+), while some of the most celebrated Indian works are still priced between ₹40-80 crore ($5M-$10M). This gap isn’t a reflection of talent but of timing. Indian art is at the cusp of a massive market correction, as global collectors and institutions increasingly turn their attention to our artists. Investing now means getting ahead of this shift—owning what could soon be considered among the most sought-after artworks in the world.

A Resilient Asset Class

During the pandemic, while the world economy came to a standstill, art remained stable. Unlike stocks, which fluctuated wildly, or real estate, which faced liquidity challenges, art held its ground. Blue-chip artworks continued to appreciate, reaffirming art’s role as a low-correlation asset that thrives even in economic downturns.

Unlike stocks, which are swayed by market sentiment, or real estate, which comes with regulatory and liquidity challenges, art moves at its own pace—often upwards. Auction houses like Saffronart, Pundole’s, Sotheby’s, and Christie’s continue to report record-breaking sales for Indian artists, a clear indicator that investor confidence in art is only growing and can outperform traditional markets.

My Journey into Art Investment

Last year, I decided to take my first step into the world of art investment. With a budget of ₹1 lakh, I visited Art Mumbai, intending to buy a sketch. As I explored different galleries, I started understanding the nuances of value—how a work on paper differed from one on canvas, and how an artist’s legacy influenced pricing.

During my search, a gallery introduced me to Himmat Shah, a revered modern master. His work intrigued me, and after some discussion, I was convinced. We finalized the price, and I asked the gallery executive to close the deal. She assured me she would get back to me—but she never did. To this day, I wonder why.

What happened next was unexpected. Himmat Shah began appearing in my dreams, as if urging me to seek him out. One day, I decided to do just that. With the help of a friend in Jaipur, I got his contact details and took a flight to meet him. That meeting turned out to be one of the most memorable experiences of my life.

I had the privilege of buying a sculpture from him—a striking four-foot piece that delves into the metaphysical world. As I was about to leave, he said something that stayed with me:

“You have taken this piece, feel free to sell it at ₹9 crore after nine years.”

We laughed, I touched his feet, and bid him farewell.

After that, my perspective on art changed completely. I realized that you remain a spectator until you buy your first piece—only then does your mind start working differently.

I had attended a Pundole auction before my first purchase, but I barely understood anything. However, after acquiring the Himmat Shah sculpture, I attended another auction by Saffronart. This time, everything made sense. It was an eye-opener.

With my growing appreciation for art, I made my second major purchase—a work by Somnath Hore, another master whose art reflects the pain and suffering of the Bengal Famine of 1943. His raw, textured forms are a reminder of the struggles that shape human history. I have never been drawn to art that simply looks beautiful; I see it as a reflection of life’s duality—pain and pleasure, struggle and survival. This piece keeps me grounded and prepared for life’s uncertainties.

Art investment, for me, is more than just buying pieces; it feels like acquiring assets, not liabilities. I now have five masters and four emerging artists on my wishlist. The journey has just begun, and I can’t wait to see how soon I can bring them all into my collection.

Institutions Transforming the Indian Art Landscape

What the Louvre is to Paris, KNMA is becoming for India.

The Kiran Nadar Museum of Art (KNMA) is redefining Indian contemporary art, providing artists with a platform that elevates their credibility and global standing. Similarly, the Nita Mukesh Ambani Cultural Centre (NMACC) is strengthening India’s artistic infrastructure, ensuring our artists receive the recognition they deserve on the world stage.

The Corporate Shift: Art as a Business Asset

Beyond private collectors, corporations are recognizing the power of art. It is no longer just about décor—it is about branding, storytelling, and workplace engagement.

A strategically curated art collection can elevate brand perception, making a statement to clients and employees alike. In boardrooms and office spaces, art fosters creativity, inspires innovation, and creates an atmosphere that encourages meaningful dialogue.

Global brands and Indian giants like Tata, Birla, and Piramal have already woven art into their corporate identity. The future will see more businesses leveraging art not just for aesthetics, but for impact.

India Art Fair 2025: A Defining Moment

The India Art Fair 2025 in Delhi was a turning point for the Indian art market. Record-breaking footfalls, international buyers, and unprecedented sales underscored a clear message—Indian art is no longer a niche investment; it is a mainstream, high-value asset class.

Social media has played a critical role in this shift, making art more accessible, shareable, and desirable. The fair’s success is a testament to India’s growing influence in the global art economy.

Final Thought: The Time to Invest is Now

History has shown us that those who recognize the value of art before the market does reap the greatest rewards. The collectors who bought a Husain for lakhs decades ago now see their investments valued in crores. The same is happening today—right before our eyes.

Unlike in the past, when we look back and say, “What if?”, today, we stand at a moment of opportunity. The Indian art market is expanding, gaining global recognition, and proving itself as a formidable asset class.

Will you look back in 20 years and say, ‘What if?’—or will you be the one telling the story of a brilliant investment and have the chance to say, “I made the right move.”

#bandanajain #sustainability #sustainableart #art #decor #uniqueart #himmatshah #somnathhore #esg #csr #artinvestment #womanartist #contemporaryart #IndiaArtFair #ArtCollectors #LuxuryHomeDecor #ArtForInteriors #ContemporaryArtist #CardboardArt #SculpturalArt #FunctionalArt #SustainableArt #UpcycledArt #RecycledMaterials